We may start each day with a plan, a schedule, and a general assumption of how life will unfold. Of course, we know life has a funny way of throwing surprises our way! Sometimes, those surprises come with costs that can shake up our financial plans or budgets.

No matter how thorough your household budget might be, there will always be unexpected expenses. It happens to everyone! Unexpected costs can be upsetting – it’s such a bummer replacing a perfectly good tire because you drove over a nail.

When we talk about unexpected expenses, the timing is usually unpredictable, but often the expense is something you knew might come up at some point. No roof lasts forever, but if a storm comes and a tree branch falls on your house, you might have to replace it sooner than you anticipated. Going forward, the best way to handle unexpected expenses is to prepare for the possibility that they may occur at some point.

Unexpected expenses typically fall into one of these categories:

- Health care emergency

- Home repair

- Pet emergency

- Automotive repair

- Tax increase

Let’s dive into how to prepare for these unexpected expenses so you can cover them without further disruption to your life, then get back to tackling the agenda items you woke up planning to tackle!

Health care emergency

In the United States, many face high healthcare costs. Healthcare Dive reports that healthcare costs for a nuclear family of four with health coverage from an employer sponsored plan were estimated to be just over $31,000 in 2023, or $7,221 for an individual. Depending on your income, health insurance options, and any medical conditions you face, healthcare may take up a sizeable portion of your family budget. Health insurance can reduce the cost in the event of a health care emergency or new condition, but the premiums alone are still a major factor in the budget of most Americans.

The unexpected expenses come into play if someone in the household suffers an accident or illness. In these situations, one of the biggest financial factors is meeting the deductible. The annual deductible is the amount you are responsible to pay before your health insurance starts covering costs.

Depending on what your plan options are, you may be able to choose between different plans that offer higher or lower deductibles. A higher deductible is usually paired with lower monthly premiums, while a lower deductible plan comes with higher monthly premiums. It’s a little bit of a gamble – if you don’t have a major healthcare costs in a given year, choosing the plan with the lower monthly premiums and higher deductible can cost less. Some plans also list an out-of-pocket maximum that the subscriber will have to pay in a given year.

And unfortunately, in the case of an accident, ambulance service and emergency room charges are often not entirely covered by health insurance. Many health insurance plans have copay percentages that apply to these bills, each of which can easily reach $1,200. For example, one of the most common copays is 20%; 20% of $1,200 is $240. If you use both an ambulance and ER, that could tally up to $480 (or more).

When you’re faced with a new healthcare cost, chances are, you’re locked in to whatever plan you decided at the time of your last open enrollment. So, to weather any surprise healthcare costs, it’s a good idea to plan ahead by keeping some funds reserved. A great goal for this amount is to have the amount of your deductible or out of pocket maximum stashed away in a high yield savings account dedicated just for medical costs. That way, you can focus on taking care of your health instead of stressing out about finances. Some people choose to use a flexible spending account (FSA) or health savings account (HSA) to which you can contribute pre-tax dollars.

Plus, you may be able to reduce healthcare costs with advance planning. Here are some options:

- Get supplemental insurance for accidents, critical illness, and hospital indemnity that can provide cash in the event of a specific event.

- Avoid high-risk activities that could lead to injury.

- Use proper safety equipment for things like sports or when using tools.

- Maintain your vehicle and practice defensive driving to reduce the risk of an accident.

- Get routine screening and preventative care done to potentially catch a problem before it becomes harder (and more expensive) to address.

Home repair

Home repair costs vary significantly by the project. For example, a new roof is needed about every 20 years. In 2024, the typical replacement cost for an average-sized home is $11,500. A new water heater is needed every eight to twelve years and installation costs range from $900 to $3,000.

American Family Insurance recommends that homeowners budget for home repairs and maintenance and set aside $1 yearly for every square foot of livable space in a house. It’s also helpful to think forward to upcoming projects and save accordingly. If you know you’ll need to replace the wood deck in five years, don’t procrastinate saving for it. Remodeling Magazine shares data on the average cost of common remodeling and maintenance projects broken down by region, so reference it for more localized information.

When you run into a situation for which you have not yet saved adequately, don’t panic:

- Loans are available to get what you need. For example, a home equity line of credit is a cost-effective way to fund home repairs. The USDA has the Section 504 Home Repair program that offers loans for low-income homeowners and grants for low-income senior citizens.

- In some situations, your homeowner’s insurance may cover some repair costs. Check your policy, and consider upgrading it or getting a home warranty for more coverage.

Renters may not need to worry about these costs in the present, but for renters who aim to buy a home, it’s smart to be aware. When purchasing a home, it’s smart to factor in some additional funds in case these issues arise soon after purchasing the home. Select a home priced accordingly so you don’t have to drain your life savings on the down payment and closing costs and leave yourself in a risky position.

Renters may also have things go wrong in their apartment or rental home and are reliant on the landlord or property management company to address them in a timely manner. Holding a renter’s insurance policy is a smart idea just in case something goes wrong, and can cost as little as $10 a month. Also, be aware of your rights as a tenant so that way if something goes wrong in the home and impacts your personal belongings, you know what is your landlord’s responsibility to cover.

Pet emergency

A pet emergency could require surgery or medication. Even if your pet does not require surgery, an aging pet may require things like specialty food or prescriptions that can improve and extend their quality of life.

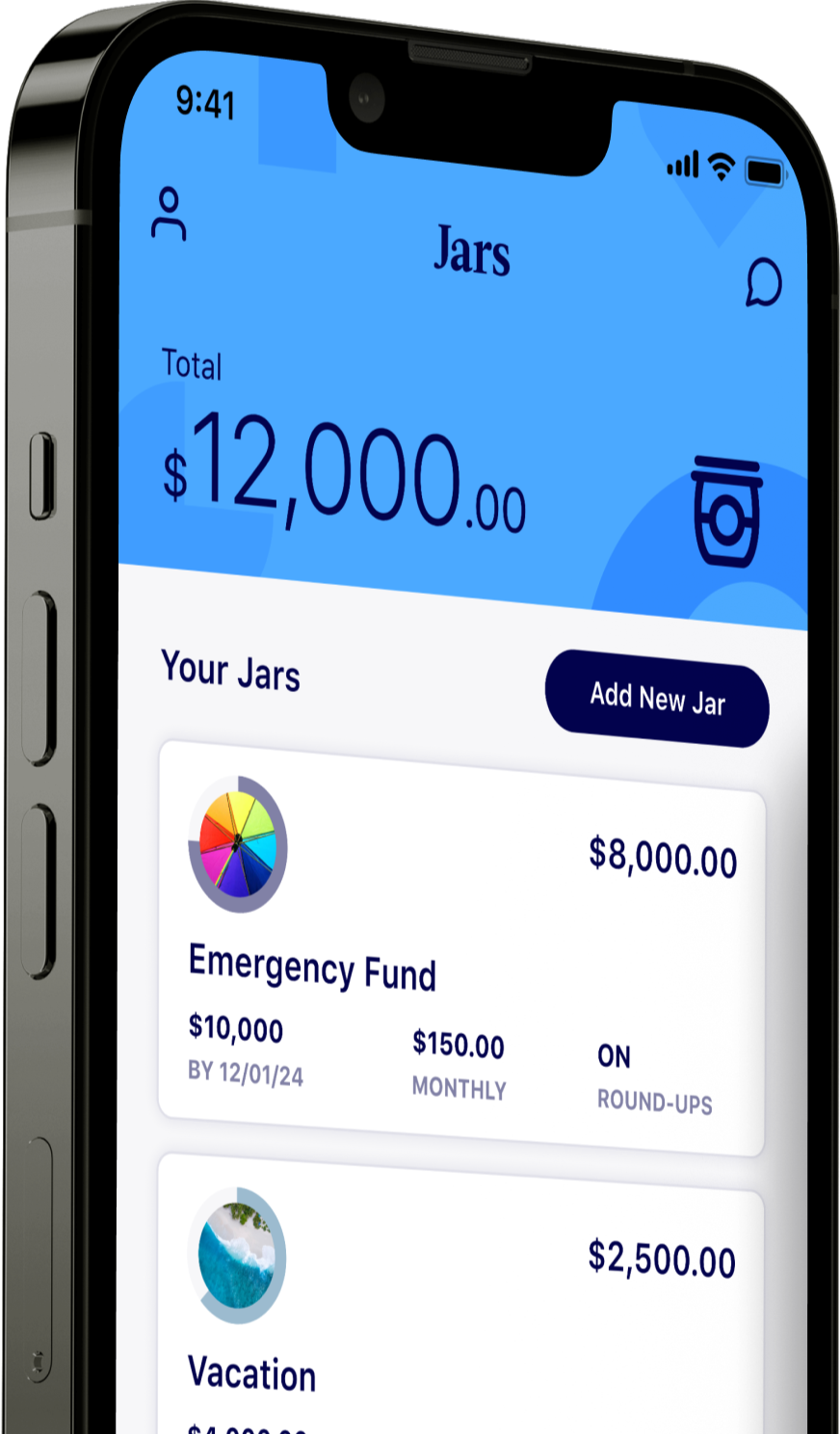

Is that a level of expense for which you can save? If so, set up a Jar and save money for the day you might need it. And, consider pet health insurance. The monthly cost of $30 to $50 could be easy enough to plug into the household budget. Like insurance for humans, deductibles and copays apply. With pet health insurance, it’s usually less expensive the younger and healthier your pet is. So, even if you don’t anticipate any problems, it may cost less in the long run to sign up sooner.

Automotive repairs

Repairs and maintenance are part of owning a vehicle, so they should not be totally unexpected. Automotive repairs can be costly; the costs vary considerably by make and model, how much you drive, the road conditions in your area, the age of your vehicle, and more.

But in general, you’ll likely have these expected auto expenses:

- Oil change every 3,000 – 8,000 miles

- Tires every 50,000 or six years (whichever comes first)

- Cabin air filters every 15,000 – 30,000 miles

- Transmission fluid every 30,000 – 60,0000 miles

So, it’s a good idea to prepare for those. Stay on top of your vehicle maintenance. Do research on the pricing of different automotive repair shops and dealer costs.

The unexpected costs come up when something breaks, or in the event of an accident. Be proactive with a good insurance policy and be familiar with what it does and does not cover. You may want to add coverage for uninsured motorists. It costs a little more per month, but can come in handy if an accident happens.

Want to save money on automotive maintenance? Look into replacing some of your trips on foot, bike, or public transportation. Consolidate car trips and carpool when you can. By reducing how much you use your vehicle, you’ll reduce the normal wear and tear, but also the chances of accidents. Low mileage can also help maintain the resale value of your vehicle as well.

Tax increases

A tax increase can be either an increase in sales tax for your locality or a property tax assessment increase for your home. If you spend $40,000 in your local community and the sales tax moves from 5% to 6%, it will cost you an extra $400 per year. If you live in a part of the country where property values are rising, a tax increase based on the value of your home could easily be $500 for a 1,500-square-foot home. If your county is talking about a tax increase, you need a tax increase Jar.

Another way to address tax increases is to understand ways you can bring down your tax liability to balance them out. Research tax deductions or tax credits for which you may qualify. Understand which tax-advantaged accounts like 401(k)s and FSAs you can use to bring down your taxable income and adjust your budget accordingly. It may take until the next time you file your taxes to see a difference, such as if you get a bigger tax refund thanks to these strategies, but can help in the long-run.

Conclusion

The only thing unexpected about unexpected costs is when they will happen and exactly how much you’ll need to spend to address the issue – but you know it’ll happen at some point! You can prepare by thinking ahead and doing research about the potential costs, looking into strong insurance policies, or changing your lifestyle to mitigate risks.

To get in an even better position to tackle these surprises, leverage Milli’s Savings Jars to budget and save for specific short and long term upcoming expenses.

Keep reading on the Milli blog:

How to Increase Income to Increase Savings