Since the world first went online, the internet has been shaking things up in the banking sector. Online account access was first offered in 1995 by Presidential Bank, and by 2006, 80% of all U.S. banks were providing some form of online service. Today, banks are making the leap from in-person banks with online services to banks that are 100% digital.

Called direct banks, online banks or – more accurate for Milli – mobile banks, the push to go digitally native is fueled by the changing technology preferences of consumers. As of 2020, more than half of the world’s population is considered part of the digital generation, meaning Millennials or younger. Raised in the era of Wi-Fi, smartphones and streaming, digitally native consumers are characterized by their preferences for convenience and speed, and that’s just what mobile banks were built for.

Let’s dig in to why you might want to consider using a mobile bank.

Always Available, Always Open

The biggest benefit of mobile banks is convenience. Your entire bank is right there in the palm of your hand! So long as your device has an internet connection, you can access all your accounts and services whenever and wherever you want. While it’s true that most traditional banks also use mobile apps, there are still some services that must be done in person, such as opening or closing an account.

But, since mobile banks don’t have physical branches, all their services are done online. So, there is no need to worry about obscure banking holidays or inconvenient hours.

Better Rates and Lower Fees

If you’ve ever used a traditional bank, you’ve probably noticed they charge a lot of fees – overdraft fees, ATM fees, transfer fees, account maintenance fees – some banks even charge fees for not using your account. Banks charge fees to help cover the operating costs of physical branches, such as rent, utilities, bank staff salaries, and building maintenance. But, they’re also a source of revenue. According to the Consumer Financial Protection Bureau (CFPB), in 2019, banks made an estimated $15.47 billion in revenue from overdraft and non-sufficient fund fees alone. No wonder lower costs are the number one reason people consider switching to a mobile bank!

With no physical presence, mobile banks have much lower operating costs, and these savings are passed on to customers in the form of lower fees. It’s the same reason mobile banks offer significantly higher interest rates on savings accounts. The average interest rate of a traditional bank is between 0.01 – 0.02% APY while the average interest at a mobile bank is 4.00 – 5.10% APY. By switching to a mobile bank, you could earn much more interest which will help you reach your savings goals faster than if you never made the switch!

At Milli, we’re proud to offer our customers a competitive interest rate, and we work to offer interest rate increases faster than even other digital banks.

More Security Options

As the most targeted industry in cybercrime, banks take security very seriously. However, when it comes to mobile banks, 34% of consumers say they don’t trust them to keep their assets safe. The truth is that mobile banks are just secure as traditional banks. They’re often using the same tools and software to process money transfers between banks or to offer debit cards. So long as a mobile bank is insured by the FDIC, it provides consumers with the same amount of account coverage and is held to the same standards.

But since mobile banks are only accessible digitally, they have an extra emphasis on digital security. One way mobile banks typically offer more security is with a larger range of security features and controls. Biometric data, two-factor authentication and device location services are commonly used to provide extra protection to customer accounts. Mobile banks also put more direct control in the hands of customers with features like card locking, verification for large purchases, and real-time alerts for suspicious activity. As digitally native businesses, mobile banks are more adept at leveraging existing device features for added security and have been much quicker to do so than traditional banks.

Mobile Banking: A Feature-Rich Experience

Whether you use a traditional bank or a mobile one, you’ll likely want to use an app either way. According to a recent Forbes survey, digital is the preferred channel for 78% of Americans. This means that banks are paying a lot more attention to their user experience. Again, here is where being an online-only business works in favor of mobile banks. While traditional banks have to split their resources between online and in-person experiences, mobile banks can focus all their attention on the digital one. In fact, improved design is a driving factor in customers looking to switch to a mobile bank.

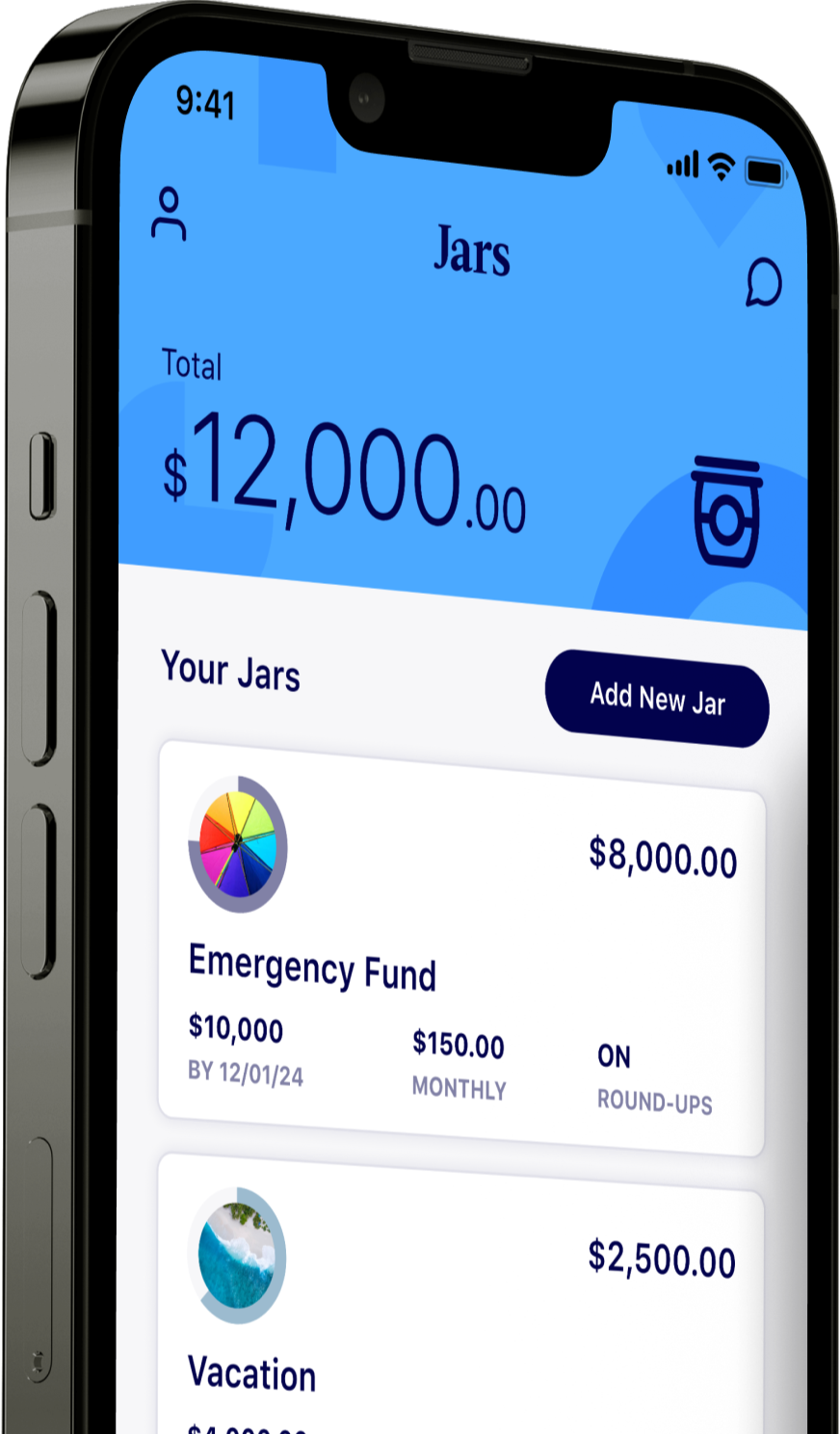

On top of improved functionality and ease of use, mobile bank experiences are also rich in features like spending insights, extended account controls and virtual debit cards. At Milli, users have a suite of features to boost their savings and gain better control over spending. Customers can save towards specific goals with our Jars and use automated rules to put money toward specific goals. Get a better picture of how, where and what you spend with customizable spending insights that can organize transactions by vendor, amount and more. Take things further by setting spending limits for specific categories or vendors to help keep yourself on budget.

The Future of Banking?

Despite the rapid growth of mobile banks, it’s unlikely that in-person banks will be replaced entirely. See, Millennials and Gen Z are also more likely to use more than one bank. Not only that, but they like to use different banks for different things. High-interest rates and the ease of moving funds make mobile banks more likely to be used for savings goals or to transfer money with friends and family. Access to financial advice and face-to-face service are what keep traditional banks in the game. If anything, the future of banking won’t be dominated by any particular model but will evolve into a diverse landscape to meet a multitude of consumer needs.

Ready to get on the mobile banking train? Download the Milli app from the App Store or Google Play and join today!

Keep reading on the Milli blog:

5 Ways to Save Money and Live More Sustainably – Simultaneously

How to Cover Unexpected Expenses

Aspirational Spending: What is it, and how to Combat It