Some of the most classic financial advice is simple: spend less than what you earn. It’s easy to understand, but living by it is a different story. As your income grows, you’ll have greater freedom of choice in the ways that you can spend your money. Many people naturally choose to elevate the things that make up their lifestyle – their living situation, transportation, and recreation.

To some degree, it’s reasonable to enjoy additional comforts big and small as your income grows! After all, if you can afford the direct flight at a convenient time, why would you put yourself through the 5 AM flight with a layover, even if it’s a better deal?

The key thing is to know where that reasonable line is – so that your lifestyle doesn’t creep beyond your means. Even if you’re living within your means and spending less than what you’re earning, you can still experience lifestyle creep. Combatting lifestyle creep all comes down to making choices in line with your real buying power. Plus, it’s imperative to keep your saving rate in check so that you can stay on track to meet your long-term financial goals.

Here, we’ll cover practical strategies to help you resist the allure of unnecessary spending while still maintaining a balanced lifestyle. Let’s dig in to how to safeguard your financial future against lifestyle creep!

Understanding Lifestyle Creep

What is lifestyle creep? It’s when someone’s lifestyle inches past their means – often so gradually one doesn’t realize it’s happening. With lifestyle creep, someone’s standard of living increases as their income does, sometimes beyond real purchasing power because of the impacts of inflation. As someone gets raises, bonuses, promotions, or new jobs, they start to upgrade and spend more money on the basics and/or optional expenses in their lives. Often, they do not keep their savings in proportion to their income.

It’s important to note that lifestyle creep is not the same as someone who has been living with insufficient means getting to a place where they can finally meet their needs. Lifestyle creep is about inflating beyond meeting your needs and treading into optional-expense territory. Lifestyle creep is also not about your expenses increasing directly because you had a child/children!

Internal and external forces can spur lifestyle creep. You might be driven by your own wants and comforts by elevating your lifestyle. You may find yourself opting for convenience or nicer things as a reward for your hard work. Or, it can happen based on peer pressure, or a desire to fit in, causing you to spend more money to keep up with your peers – whether it’s something you personally care about or not.

Implications of Lifestyle Creep

Now, let’s dig into what can happen if your lifestyle inflates. There are two key impacts: financial, and psychological.

Financial impacts

We don’t want to sound harsh, but we would be remiss if we didn’t clearly call out that lifestyle creep poses a threat to your financial stability. First, the clearest impact is the possibility of derailing your savings. It can spell trouble if you find yourself struggling or unable to save for emergencies, other planned or regular expenses, or retirement, because your expenses are siphoning a higher proportion of your income.

Another impact is should you experience a reduction or total loss in income, you have to find a way to keep up with higher expenses. But if you keep your expenses lower, it can be easier to handle and make it through. For example, if your basic living expenses are $3,000 a month, then a six-month emergency fund would come out to $18,000. But if your expenses are $5,000 a month, then that same six-month fund would require $30,000. Another kicker is that higher sum can be harder to save up for if extra money is going to things like higher housing and utility costs, transportation, and recreation.

If you’ve taken out loans to float the cost of these things, the interest you’ll pay on the loan also makes it more expensive compared to if you were able to buy the item in full. If you default on loans at any point, it can negatively impact your credit score as well.

Psychological impacts

In the short-term, having a nicer lifestyle has a lot of perks – it’s why this phenomenon happens! Some people may feel satisfaction and comfort thanks to the things in their life. In the moment, it’s more pleasant to enjoy things like a nicer home, and the ease of more convenient options.

However, it can cause negative psychological impacts in the long term. The financial implications of lifestyle creep can cause stress about how to continually meet higher financial obligations. It can also cause you to feel backed in a corner when it comes to making decisions that involve money. If you find yourself disliking or feeling unfulfilled by your job, but you need that salary level to afford your lifestyle, you may not have the logistical freedom to find another role that makes you happier or fulfilled if it comes with a pay cut. Or, you may have to downgrade your lifestyle to make such a change, which can be an uncomfortable adjustment.

Strategies to Avoid Lifestyle Creep

Avoiding lifestyle creep involves practical changes and a mindset shift. Here are a variety of ways you can use to prevent this!

Set clear financial goals

When you have something specific you’re working toward, that makes it easier to stay on the course of financial wellness. Choose a goal to give you a purpose for your money. Perhaps it’s paying back student loans, building an emergency fund, buying or renovating a home, or saving for retirement (or multiple goals). You’ll get more motivated to save and build those strong financial habits when you care about what you’re working toward!

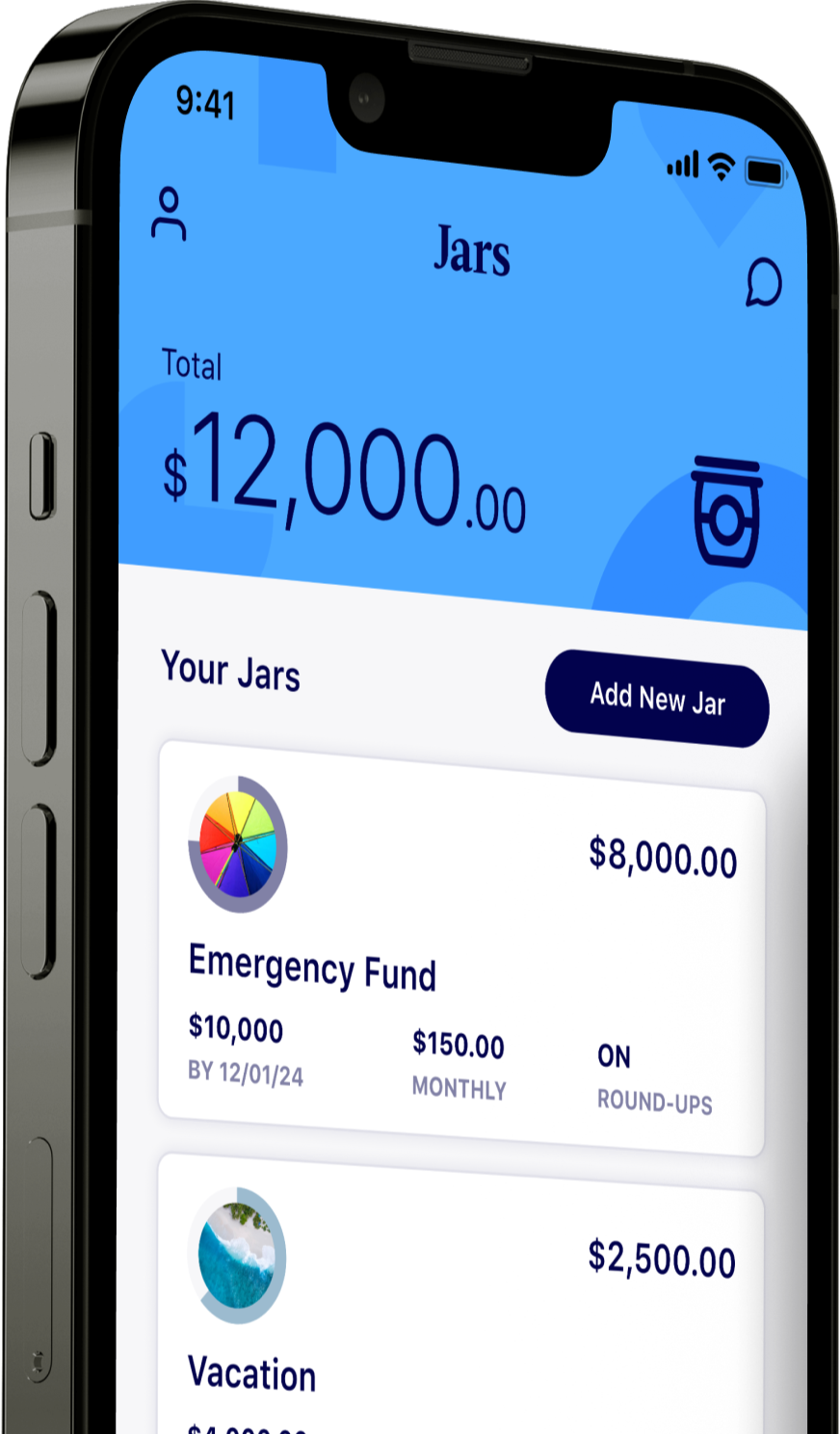

Need a dedicated spot to save? Create a Jar in Milli to help you work toward this goal. Set a goal amount and a timeline, and Milli will tell you how much you need to save at regular intervals to reach it.

Budget

No surprises here – to combat lifestyle creep, you need to create a budget and stick to it. Track your expenses and be intentional with how much you need to spend on essentials, savings, and wants.

When you make your budget, be sure to account for leisure/recreation! Money is a tool to help us build the life we want, so let it serve you in this way. The key is to challenge yourself to keep the amount you spend on the core line items in your budget flat even as you grow your earnings – or at least raise it more slowly – so that you free up more room to dedicate money to long-term goals.

Save first

This is where the behavior modification comes in. Part of making your budget work for you is to save first, not save whatever is left over after spending. Carve out the amount you can save in your budget and automate it to the best of your ability. Set up direct deposit or automatic transfers into a high yield savings account and get informed about how you can automatically save for retirement as well! Then, over time as your income grows, if you get a raise beyond just a cost-of-living adjustment, increase your saving rate. This will help keep your spending in check and give you a bigger financial cushion.

If you pay off debt and free up room in your budget, see how you can put more of that newfound disposable income toward savings or tackling other debt. If you get a windfall (like an unexpected bonus, tax refund, inheritance, class action lawsuit settlement) orient toward using it to pay down debt or put it toward your new savings goal. However, if you have a specific need for the money, like replacing something that is broken, that’s a good option as well. This can help you get back on track financially and habitually.

Keep expenses low

This one is key to success: keeping expenses relatively low is key to avoiding lifestyle creep. The goal is to maintain your current standard of living rather than living as cheaply as possible. However, if you see areas to trim back, that’s great too!

What does this look like in practice?

- Using what you have, whenever you can.

- Looking for more budget-friendly choices when you are shopping for both needs and wants.

- If something works, using it until it stops being functional rather than replacing it prematurely.

- Maintaining the things you own, especially expensive things like vehicles or appliances, because it’s more cost-effective than replacing new.

- Making choices based on what’s in your budget.

- Exploring reasonable alternatives when pricier expenses pop up.

- Loud budgeting – being transparent with others about sticking to your financial goals.

Be mindful of inflation

We’ve been seeing it the last few years: inflation makes necessities cost more over time. It’s important to understand your real purchasing power, which is how much your currency is worth. Over time, with the rising cost of goods and services, the same sum of money will gradually be able to buy fewer goods. Even for someone who does not inflate their lifestyle with their optional choices, this can impact their financial situation.

If you get a modest raise or cost of living adjustment, it may feel like you have more money to spend. However, you must keep in mind that all that additional money may only cover the increased cost of bills and necessities. Your real purchasing power is likely to be the same – so there’s no extra money for the splurge purchase on your mind.

Being informed about inflation helps you adjust your budget to reflect what’s realistic to spend and save, so you don’t inadvertently inflate your lifestyle. If your wages don’t keep up with inflation, you may have to explore new opportunities so that you can keep your savings on track rather than backsliding in purchasing power despite gaining more years of experience.

Be clear on your values

We’ve talked about the literal ways to combat inflated spending, but it’s important to connect our finances back to something deeper. To keep your spending in check and genuinely serving you, identify your core values, and make it a point to spend money in a way that celebrates those. It’s easier to avoid overspending when you’re orienting your lifestyle and financial choices around the things you intrinsically care about.

Practice gratitude

Gratitude is another powerful antidote to lifestyle creep. When you truly appreciate what you have, it makes it easier to not feel like you’re missing out when you skip unnecessary purchases. Gratitude helps mitigate the desire to spend and keep up with others because you’re genuinely satisfied with what you have – both material and immaterial things.

Start a gratitude journal or set a reminder each day to pause for even one minute to identify something you’re grateful for. It can be a material item or intangible, or a bit of both – like how having a physical item brings about a positive benefit to your life. You’ll be amazed how your perspective shifts over time. It’s empowering!

Conclusion

Lifestyle creep is a good reminder that financial health is a journey. It’s clear: financial wellness encompasses both practical strategies and mindful habits. Budgeting and keeping your buying power in check can help with keeping the financial numbers where they need to be to support your needs. On the behavior side, mentally shifting towards conscious spending and contentment with what we have helps push back against the allure of unnecessary expenses. It’s all about reframing your perspective to feel empowered, rather than limited!

If you’re looking for a mobile bank to make it easy to keep your spending in check and save up for your goals, check out Milli. Our helpful spending features, savings tools, and competitive Annual Percentage Yield help you save more for the things that matter most. Download the app on the App Store or Google Play and get started today!

Keep reading on the Milli blog:

How to Save Money when the Cost of Groceries Rises

Aspirational Spending: What is it, and how to Combat It

Asset Allocation Among Americans: Where People Keep Their Wealth